DBS business account: Guide on DBS business banking for SMEs

- •DBS business banking: Overview

- •How to choose the right DBS corporate banking solution for your business?

- •DBS Business Multi-Currency Account: Overview and comparison

- •5 reasons to get a multi-currency business account

- •Comparison: DBS Business Multi-Currency Account versus OCBC and Airwallex

- •Alternative solution for international businesses: Airwallex Business Account

- •How to open a DBS Business Multi-Currency Account?

- •Conclusion

When you think about SME banking, DBS and OCBC bank are one of the first banks that come to mind. As Singapore’s leading bank, DBS serves over 280,000 businesses1 with a range of financial solutions. The DBS Business Account is specifically built to help SMEs manage their day-to-day operations and scale their business.

Before opening a business account in Singapore, it helps to also explore financial technology solutions or compare different business bank accounts, comparing their features and fees. The Airwallex Business Account offers similar benefits as DBS SME banking, but with added benefits like no annual fees, instant corporate card issuance, and low-cost international transfers to 110+ countries.

In this article, we’ll take a look at DBS business banking for SMEs, its features and benefits, and the account opening process. We’ll also explore why Airwallex can be a good fit for ambitious businesses seeking cost-effective global payments and streamlined financial operations.

DBS business banking: Overview

DBS has several banking services to help SMEs manage their funds and access working capital. Here are some of the business accounts and banking packages they offer.

DBS Business Multi-Currency Account. The DBS Business Multi-Currency Account lets SMEs hold and manage SGD along with 12 other currencies in a single account. New businesses incorporated less than 3 years can avail of the Starter Bundle, which comes with unlimited FAST and GIRO transactions.2

Corporate Fixed Deposit Account. Businesses with surplus cash can use this account to get higher yields on SGD and 10 other foreign currencies. All you need is a minimum amount of SGD 5,000 or its equivalent in foreign currency. You can choose a fixed tenor of up to 12 months.3

Business for Impact Banking Package. Social enterprises and SMEs that drive environmental impact can use this banking package for their day-to-day operations and their business’s growth. The package includes the DBS Business Multi-currency Account and access to working capital loans. Businesses get a suite of digital solutions from the Start Digital Programme, and employee training from the Skills Booster Programme.4

Heartland Merchant Banking Package. Businesses that serve Singapore’s heartlands can avail of this package with solutions for day-to-day transactions payments collection. Included are the DBS Business Multi-currency Account, free insurance coverage against legal liabilities, and business loans with 50% off processing fees.5

Conveyancing Account for law firms. This account is only available to law firms and allows them to collect conveyancing money from clients according to Ministry of Law guidelines.6

How to choose the right DBS corporate banking solution for your business?

When choosing a DBS SME account, consider what you need the account to accomplish and what solutions will drive your business’s goals. Do you need a simple way to collect customer payments and handle payroll? Or does your business require an injection of working capital to expand your operations?

If you’re among the 60% of new businesses prioritising first-time overseas expansion7, a multi-currency account can be useful, as it allows you to manage multiple currencies in one place and streamline international payments.

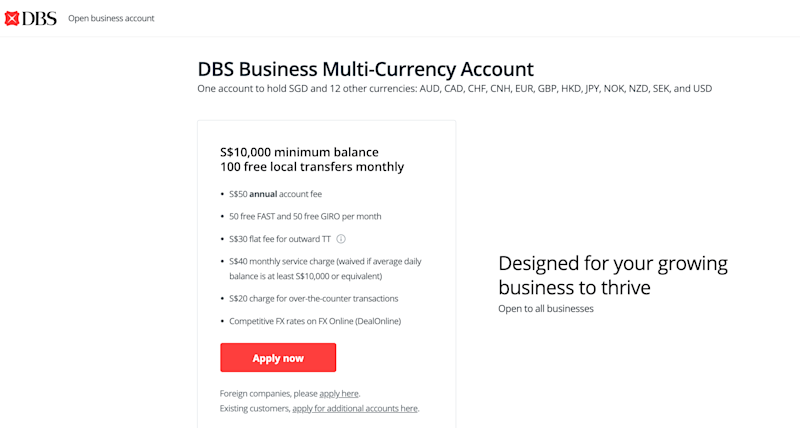

DBS Business Multi-Currency Account: Overview and comparison

The DBS Business Multi-Currency Account allows SMEs to hold and manage multiple currencies in a single account. Businesses can accept, hold and send SGD and 12 other leading currencies, including USD, EUR, and GBP. This makes it ideal for businesses with international customers or who are planning to expand to new markets.

With this account, you can enjoy the following benefits:

Flat rate for telegraphic transfers. Pay SGD 30 plus agent fees for every international money transfer service.

Competitive exchange rates. Once you get the Business Account, you can sign up for FX Online, DBS’s online platform for currency conversions. You can book foreign currency transactions at your desired rate, for up to a year in advance. You’ll see the rates on the DBS FX Online dashboard.8

No minimum opening deposit. There is no minimum opening deposit or account opening fee, but you need to maintain a balance of at least SGD 10,000 (or its equivalent in foreign currency) to avoid the SGD 40 monthly service charge.

Even if your business transacts primarily in SGD, you can enjoy benefits like 50 free GIRO and FAST transactions per month. This account also gives you access to various domestic payment services, such as:

PayNow Corporate. This service lets you collect SGD payments via your Unique Entity Number (UEN) or your PayNow QR code.9

GIRO payroll. Pay your employees on time and accomplish your monthly payroll in one debit transaction.10

DBS MAX. Use the DBS MAX app to collect cashless payments via PayNow, Paylah! Or cards at your POS terminal or eCommerce store.11

Finally, if your business was incorporated within the last 3 years, you may be eligible for the Starter Bundle. This lets you enjoy unlimited free FAST and GIRO payments (excluding bulk transactions and payroll), and no monthly service charge.

5 reasons to get a multi-currency business account

You might be wondering why you need a multi-currency account if most of your business’ transactions are in SGD. Here’s why this is a strategic decision:

Flexibility for growth. In 2023, there was a 66% increase in companies that ventured to overseas markets for the first time12. Having a multi-currency account prepares you for future expansion into international markets without the need to open additional accounts.

Paying overseas suppliers. In 2023, Singapore businesses imported SGD 27.8 billion worth of manufactured goods.13 A multi-currency account lets you pay suppliers in China using CNY, which reduces potential exchange rate disputes.

Paying outsourced employees. SMEs are increasingly outsourcing entire functions like payroll or IT support to manage costs.14 A multi-currency account enables you to pay them in their local currency, simplifying payroll and minimising conversion fees.

Accepting eCommerce payments. A multi-currency account simplifies overseas expansion by allowing your business to accept eCommerce payments in foreign currencies. This lets you minimise unnecessary conversion and the fees that come with it.

Hedge against foreign exchange risk. A multi-currency account minimises foreign exchange fees by allowing you to hold and manage different currencies directly, reducing the need for frequent currency conversions. Holding various currencies also lets you hedge against exchange rate fluctuations.

Comparison: DBS Business Multi-Currency Account versus OCBC and Airwallex

Finally, let’s take a quick look at how the DBS Business Multi-Currency Account measures up against two similar competitors: the OCBC Multi-Currency Business Account and the Airwallex Business Account.

DBS Business Multi-Currency Account | OCBC Multi-Currency Business Account | Airwallex Business Account | |

|---|---|---|---|

Eligibility for online account opening | Singapore registered businesses fully owned by Singaporeans or Permanent Residents | Singapore registered businesses fully owned by Singaporeans or Permanent Residents | Singapore registered businesses |

Account opening fees | ❌ | ❌ | ❌ |

Account fees | SGD 50 annually, or SGD 10 per month for Starter Bundle | ❌ | ❌ |

Minimum initial deposit | ❌ | ❌ | ❌ |

Service charge | SGD 40 per month* | SGD 10 per month**

| ❌ |

Daily average balance requirement | SGD 10,000 | ❌ | ❌ |

Fall-below fee

| ❌ | ❌ | ❌ |

No. of foreign currencies in account | 12 | 13 | 23+ |

International transfer fees | SGD 30 + agent fees + cable charges | SGD 30 + agent fees

| Free for local transfer methods to 110+ countries SGD 20 - 35 for SWIFT transfers |

Corporate cards

| 1 free debit card with 0.3% rebate on corporate purchases | 1 free debit card with up to 1% cashback*** | Unlimited physical and virtual Borderless Cards with 1% unlimited cashback on domestic and international spend |

Domestic payments | FAST and GIRO | FAST and GIRO | FAST only |

Sources: DBS Multi-Currency Business Account, DBS SME portal, OCBC Multi-Currency Business Account, OCBC Business Growth Account as of 20 May 2024

*waived if average daily balance is at least S$10,000 or equivalent

**waived if you open a Business Growth Account together with the OCBC Multi-Currency Business Account

***if you open a Business Growth Account together with the OCBC Multi-Currency Business Account

Alternative solution for international businesses: Airwallex Business Account

If overseas expansion is your business’ top priority, let Airwallex take you there. Our full-featured multi-currency Business Account has everything you need to grow your business beyond Singapore. Our multi-currency accounts support batch transfers for international payroll and global suppliers and we also carry solutions that traditional banks don’t offer, such as eCommerce integrations, multi-currency payment gateways, and virtual debit cards.

Here are some ways your business can benefit from Airwallex:

Multi-currency Global Accounts. Instantly create 23+ foreign currency accounts with local bank details, including branch codes and dedicated account numbers. You can receive payments in USD, GBP, EUR, CNY, and more without the hassle of setting up a bank account in the markets you’re entering.

Low-cost international transfers. We partner with a wide network of local payment rails to enable low-cost global payments. There are no transfer fees for most currencies if you use local rails to send payments in 110+ countries. Flat fees of SGD 20 - 35 apply for SWIFT transfers to 150+ countries.

Market-leading exchange rates. Airwallex gives you access to interbank exchange rates - the real exchange rates banks use to trade currency, minus the hefty markup. We charge a small markup above the interbank rate, and offer currency risk management features so you can lock in your preferred exchange rate.

Instant Borderless Card issuance. Issue unlimited physical and virtual debit cards for free and use it wherever VISA cards are accepted. You get 1% unlimited cashback and no foreign transaction fees for 23+ currencies when you pay using the balances in your Airwallex multi-currency account.

eCommerce payment gateway. Airwallex’s payment gateway easily integrates with Shopify, Woocommerce, and other leading eCommerce platforms. Create seamless checkout experiences in 180+ countries and accept 180+ currencies using 160+ local payment methods.

Automated bulk payments. Save time paying bills, employees, and suppliers. Send batch transfers for up to 1,000 recipients across countries, currencies, and transfer methods.

No hidden fees. We don’t charge account management fees or service fees. You only need to pay for the services you use, and you can anticipate how much you’ll spend using our transparent fee schedule.

We’re not a bank, but Airwallex (Singapore) Pte. Ltd. is licensed in Singapore as a Major Payment Institution and is regulated by the Monetary Authority of Singapore (License No. PS20200541). Airwallex Singapore implements stringent safeguarding measures for our customers’ deposited funds according to MAS and global regulations.

How to open a DBS Business Multi-Currency Account?

The DBS Business Multi-Currency Account is available to all Singapore-registered companies, from sole proprietors to private limited companies. However, the Starter Bundle is only available to new businesses that have been incorporated within the last 3 years.

Here’s how to do it:

Step 1: Prepare the required documents15

The required documents vary depending on your company’s structure. In general, you’ll need to have the following soft and hard copies ready:

IC (Singaporeans and Permanent residents) or valid passport and work pass

Proof of residential address for all signatories (i.e. bank statement, utilities bill)

Proof of Principal Place of Business (if your business’s location is different from the registered address)

Certified True copy of Resolution

Partnership Agreement or Declaration of Ownership

Step 2: Complete the online application form

Fill in the application form and obtain the signatures of all partners or at least 2 directors (if applicable).

Step 3: DBS will be in touch for next steps

Check your email or wait for a phone call from a DBS relationship manager.

If your company is fully owned by Singapore citizens or permanent residents, the DBS corporate account opening process can be done online and you will receive an email notification. Otherwise, you may need to make an in-person visit to complete the process.

Conclusion

If you want to use a leading bank like DBS, the DBS Multi-Currency Business Account is worth considering. You can access a variety of banking services online and in person. New businesses can even save on FAST and GIRO fees with the Starter Bundle.

The downside is the range of fees they charge. There’s a monthly fee for the Starter Bundle, and per-transaction charges for both domestic and international payments. You also need to pay fees if your monthly balance falls below SGD 10,000, which can put a strain on your working capital. Be sure to examine the fee schedule and terms and conditions to get a full picture of the charges you need to pay.

With the Airwallex, you get the benefits of a multi-currency account, with no minimum balance requirements and low, transparent fees. You also get low or no transfer fees when you use local payment rails to send funds to 110+ countries.

Singaporean businesses like Saturday Club, Igloohome, and EU Holidays already use Airwallex to achieve global success and maintain strong margins. See for yourself and open a free Airwallex account today.

Frequently asked questions

1. What is the minimum balance for a DBS corporate account?

The minimum balance depends on the account type. For the DBS Business Multi-Currency Account, a monthly fee of SGD 40 applies if your balance falls below SGD 10,000.

2. What is a DBS SME Centre?

The DBS SME Centres are dedicated support hubs for small and medium-sized enterprises (SMEs) in Singapore. They have dedicated relationship managers on-site to offer personalised advice and financial solutions to help businesses grow more effectively. DBS SME Centres are located across the island, and you can visit by making an appointment via phone.

3. How long does it take to open a DBS business account?

The DBS business account opening process can take several business days. To avoid delays, make sure you submit all the required documents.

Sources and references

1. https://www.dbs.com/iwov-resources/images/investors/quarterly-financials/2023/DBS%20Annual%20Report%202023.pdf

2. https://www.dbs.com.sg/sme/day-to-day/accounts/dbs-business-multi-currency-account

3. https://www.dbs.com.sg/sme/day-to-day/accounts/fixed-deposit-account

4.https://www.dbs.com.sg/sme/day-to-day/accounts/business-for-impact-banking-package

5. https://www.dbs.com.sg/sme/day-to-day/accounts/heartland-merchant-banking-package

6. https://www.dbs.com.sg/sme/day-to-day/accounts/conveyancing-account

7. https://www.dbs.com/NewsPrinter.page?newsId=lfazyz9z&locale=en

8. https://www.dbs.com.sg/global-financial-markets/forex-and-commodities/fx-online

9. https://www.dbs.com.sg/sme/paynow

10. https://www.dbs.com.sg/sme/day-to-day/payments/domestic-funds-transfers/giro-payroll

11. https://www.dbs.com.sg/sme/max

12. https://www.straitstimes.com/business/companies-markets/more-singapore-firms-venturing-overseas-to-grow-enterprisesg

13. https://www.singstat.gov.sg/modules/infographics/singapore-international-trade

14. https://www.businesstimes.com.sg/singapore/smes/more-smes-outsource-back-end-roles-amid-rising-business-costs-labour-shortages

15. https://www.dbs.com.sg/documents/276102/282858/account-opening-checklist.pdf

***Note: This publication does not constitute legal, tax, or professional advice from Airwallex nor substitute seeking such advice, and makes no express or implied representations / warranties / guarantees regarding content accuracy, completeness, or currency.

Share

Shermaine spearheads the development and execution of content strategy for businesses in Singapore and the SEA region at Airwallex. Leveraging her extensive experience in eCommerce, digital payment solutions, business banking, and the cross-border industry, she provides invaluable insights that guide businesses through the complexities of global commerce. Specialising in crafting relevant and engaging content that resonates with business owners, her work is designed to drive growth and innovation within the fintech and business economy space.

View this article in another region:Hong Kong SAR - EnglishHong Kong SAR - 繁體中文

Related Posts

Best ways to send money internationally from Singapore in 2025

•10 min

AliExpress dropshipping in Singapore explained: Guide for busines...

•10 minutes